Home renovation projects aren’t cheap. In recent times, thanks to the increased cost of materials, they’ve become even more expensive. Because of this, it can be tempting to cut corners or lower the quality of the renovation.

What if there was a way you could potentially save money, though? You’d get the remodel you’ve always dreamed of without necessarily breaking the bank.

We’ll let you in on a secret. Some home renovations are tax deductible. Before you shout “hooray” and rush to book that contractor, it’s important to understand that this only applies in certain circumstances. Read on to see if your project is eligible.

Are You Increasing Energy Efficiency?

Energy efficiency is the hot topic around home renovations right now. With rising energy prices and the threat of climate change, the government is keen to get everyone’s homes as efficient as possible. And it’s worth doing it too.

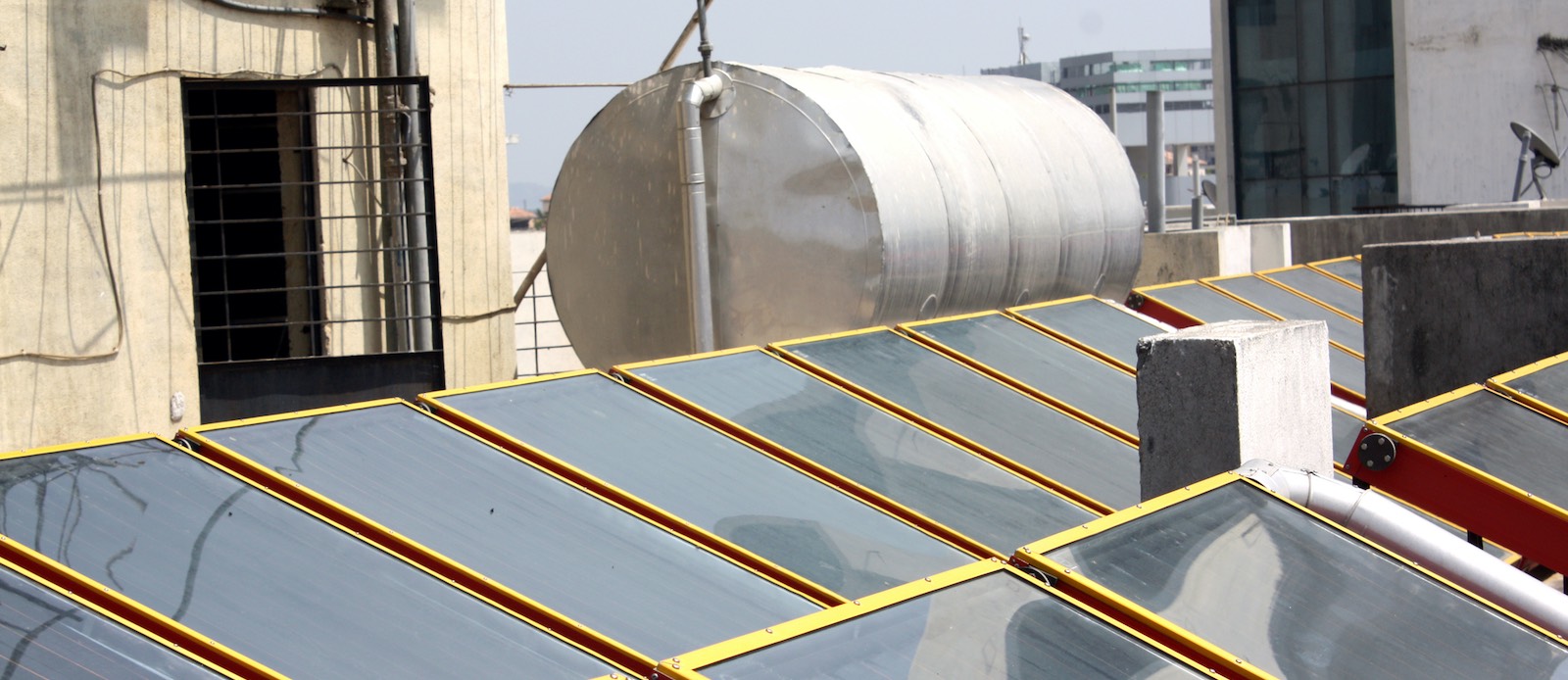

If you upgrade your home systems to energy-efficient alternatives, you can enjoy a tax credit. We’re talking solar panels, geothermal heat pumps, and solar heaters here. If you’re planning to get any of these fitted, check and see what you’re eligible for. You can even claim retrospectively, so if you’ve already made the changes, you could be in the money.

The tax credits are allocated as follows:

- 30% for upgrades made between Dec 31, 2016 – Jan 1, 2020

- 26% for upgrades made between Dec31, 2019 – Jan 1, 2023

- 22% for upgrades made between Dec31, 2022 – Jan 1, 2024

- 26% for the installation of a solar energy system in 2022

Any product that is recognized as “energy star” is eligible to qualify for the tax credit, so check before you buy to ensure you can claim it.

How Does the Tax Credit Work?

A tax credit is an amount you can subtract from what you owe the IRS. Essentially, it reduces the amount of tax you owe in that year. You cannot withdraw it as cash or use it in any other way. When you go to file your yearly taxes, you can claim the credit at the same time.

Do You Use Your Home for Work Purposes?

Now let’s move on to the tax deductibles. First up is the home office.

The way we work has drastically changed. Now, more than ever, folks are turning to flexible working solutions and remote working. This has led to the requirement for homes to be transformed into workspaces.

The government has recognized this need and will allow you to deduct the tax on any renovations for work and home office purposes. Therefore, if you need to create a new addition to the home, renovate an existing room, or transform the garage into an office space, all of this will be tax-deductible.

You can deduct taxes from the cost of improvements that are solely for the purpose of a home office

If your home office is part of a wider renovation project, you can claim the percentage amount. For example, if a home office accounts for 25% of the renovation, this is what you can claim for a tax deduction.

Do You Need to Renovate for Medical Reasons?

If you need to modify your home to accommodate aging or a medical condition, you can claim the tax deductions. This includes modifications that improve mobility and quality of life, such as widened walkways, lifts, ramps, medical equipment installation, and support bars.

You can deduct taxes from 100% of the cost of medical care home improvements.

Do You Rent Out Your Property?

If you have a rental property, it is possible to claim for repairs and upkeep of it. This is because they are deemed necessary to continue earning an income from the property. Any remodel, renovation, kitchen or bathroom installation, and general improvements are tax deductible.

It’s worth knowing that this also applies if you rent out part of the home you live in. For example, if you rent out an annex on your property, you can deduct taxes from any improvements you make to the area that’s rented out.

You can deduct taxes from 100% of the cost of home improvements on rented property.

Are You Planning to Sell Your Property?

If you plan to sell your property, you need to ensure it’s in tip-top condition. This usually involves upgrading old and dated areas and installing safer, better home systems. If you don’t, you could see your house sitting on the market for years or selling well below market rates because no one wants to buy an unattractive property.

The good news is that if you carry out renovations before selling, you can deduct the tax on these once the home sells. The absolute vital point here is that you must keep accurate records of your expenditure, including all the receipts.

The following home improvements for resale include:

- Attic or basement renovations

- Adding another area or space to the home

- Adding a swimming pool

- Furnace installation

- New bathroom addition

- You can deduct taxes from 100% of the cost of anything noted above.

What Can’t You Claim For?

If you use your home solely as a personal residence, any renovations you make won’t be tax-deductible unless they relate to anything noted above. For example, if you want to replace your kitchen with an upgraded model, you won’t be able to deduct taxes from any part of the cost.

Overall, tax deductibles are a great way to save on some of the cost of home improvements as long as they’re for a qualifying reason. Our pro-tip is to always choose energy star replacements for your home systems so you can enjoy that nice tax credit. After all, who doesn’t like paying less tax?